Portfolio Management

Efficiency Isn’t Just Smart—

It’s Essential

At DeGreen Private Wealth, we manage portfolios with one goal in mind: to deliver maximum long-term value with as little unnecessary cost, complexity, or risk as possible. That’s why we build client portfolios using low-cost, tax-efficient exchange-traded funds (ETFs)—and why we focus on proactive, personalized management every step of the way.

What We Offer

You don’t “diversify” by hiring multiple managers. That’s your advisor’s job. When too many people are managing slices of your wealth independently, you end up with overlap, higher fees, and unintended risk. We manage everything with a full view of your assets so nothing gets duplicated, lost, or misaligned.

Cost-Efficient Structure

ETFs typically cost a fraction of what traditional mutual funds and annuity subaccounts charge. Even after our advisory fee, our managed ETF program often costs less than what many investors pay in higher-fee products—and that’s before you factor in the value of professional guidance.

Risk-Adjusted Portfolios

We don’t chase returns. We manage risk. Every portfolio is built based on your personal goals, timeline, and comfort with volatility—then rebalanced over time to stay aligned with what matters most to you.

Fee Transparency & Flexibility

We don’t hide fees or nickel-and-dime our clients. Our annual fee is deducted quarterly in advance based on the total value of the accounts we manage for you. You’ll always know what you’re paying—and what you’re getting in return. If you ever decide to move on (we hope you don’t), any unearned fees are promptly refunded.

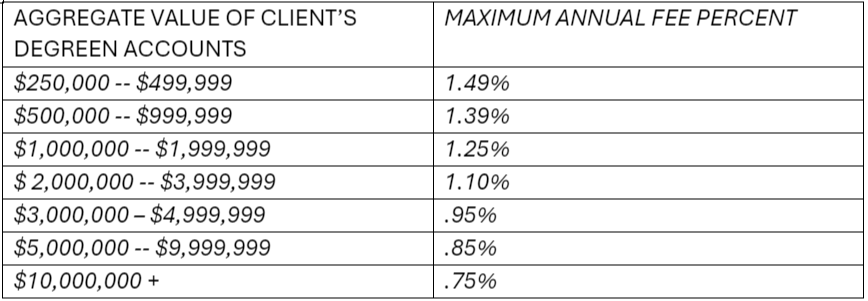

DeGreen Private Wealth LLC Maximum Fee Schedule

DeGreen’s fees are based on the aggregate size of the Clients account(s) under DeGreen Private Wealth's management and are expressed as an annual percentage of the total asset(s) under management. Therefore, for example, a 1.00% annual management fee will be assessed quarterly as a .25% debit against the Clients accounts.

DeGreen reserves the right to reduce the maximum fees stated above in selected circumstances depending on the nature of a Client’s accounts, aggregate or promised aggregate account size, the Client’s relationship with DeGreen, and other factors.